Imagine you’ve just launched your very first online store. Everything looks perfect—your products are live, the website is sleek, and marketing is bringing in customers.

Then comes the big question—how are you going to accept payments?

You want something simple, secure, and easy to set up. This is where you might hear terms like “payment gateway” and “payment orchestration.”

But what do they mean, and which one fits your needs as a small business owner?

Let’s break it down step-by-step, so you can make the best decision for your business.

What is a Payment Gateway?

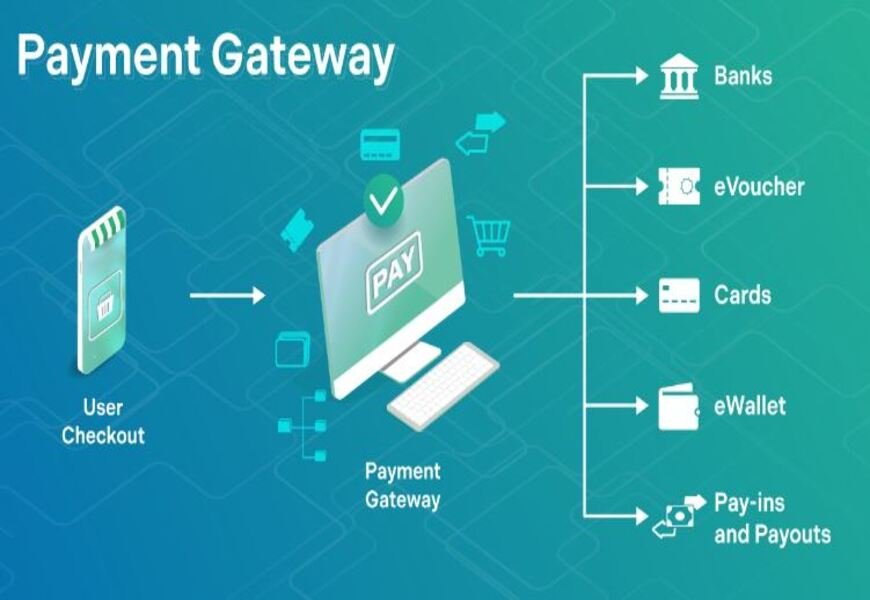

Think of a payment gateway like a cash register in a store. It’s a digital tool that collects your customer’s payment information and processes the transaction.

Whether someone is paying with a credit card, debit card, or even through a digital wallet like PayPal, the payment gateway makes the exchange happen securely and smoothly.

It’s the bridge that connects the customer’s bank to the business’s bank so money can be transferred safely.

Key Features of Payment Gateways:

- Secure Transactions: It encrypts sensitive customer data, like credit card numbers, to keep them safe.

- Efficiency: Checks for sufficient funds and handles approvals in seconds.

- Popular Providers: Examples include PayPal, Stripe, and Square.

How It Works:

- A customer enters their payment details at checkout.

- The payment gateway encrypts this data and sends it to the bank for authorization.

- Once approved, the funds are transferred to your account. Payment gateways are simple to set up and great for small businesses just starting out. But they have limits, especially as your business grows.

Limitations:

- Lack of Flexibility: Most gateways only work with specific payment methods or banks.

- Scaling Issues: If you’re targeting international customers, you may struggle with local payment methods or multiple currencies.

- Higher Costs: Each transaction comes with fees, which can add up as your sales grow. By 2025, the payment gateway market is expected to grow to $47 billion due to the surge in ecommerce payments.

What is Payment Orchestration?

If a payment gateway is like a cash register, a payment orchestration platform is more like a business manager for all your payments.

The main purpose of payment orchestration is to simplify and optimise how businesses accept and process payments. Instead of managing multiple systems, payment orchestration combines them under one platform. This makes it easier for businesses to handle a wide range of payment methods, currencies, and processors without juggling multiple tools.

It also helps businesses save time, reduce costs, and offer a smoother payment experience for their customers.

Payment orchestration is particularly valuable for businesses handling complex or global transactions. For example, if you run an international ecommerce business, you likely deal with customers using different currencies, payment methods, and banks.

Without orchestration, you might need separate integrations for each country or method. This can make managing payments really messy and expensive. Payment orchestration solves this by unifying everything, making it simple to manage from one place.

By tailoring payment options to match customer preferences, payment orchestration helps improve sales and customer satisfaction. For instance, if customers prefer digital wallets or buy-now-pay-later options, it’s easy to add these to your checkout without major changes to your systems. This flexibility gives businesses a competitive edge in today’s fast-moving ecommerce world.

Overall, payment orchestration is all about improving the way businesses handle payments. It’s not just a tool—it’s a strategy for growing efficiently, cutting costs, and ensuring a world-class experience for customers.

Key Features of Payment Orchestration:

- Integration Power: Connects various gateways, banks, and payment methods into one system.

- Dynamic Routing: If one gateway goes down, it automatically reroutes payments to another provider.

- Advanced Analytics: Offers insights into payment trends and customer behavior.

- Security Options: Customizable fraud protection tools.

How It Works:

- A customer selects a payment method at checkout.

- The orchestration platform decides the best gateway or provider for that transaction based on factors like cost, location, or success rate.

- It processes the payment and settles the funds in your account. Payment orchestration gives you more control, flexibility, and cost savings. It’s especially useful for businesses handling cross-border payments or scaling globally. The payment orchestration market was valued at $1.45 billion in 2023 and continues to grow as businesses demand better ecommerce payment solutions.

Limitations:

- Complex Setup: Initial implementation and integration can take time and technical resources.

- Higher Upfront Costs: While it saves money in the long run, upfront expenses may be high for small businesses. For companies managing several payment gateways or handling complex payment flows, orchestration is a game-changer.

Side-by-Side Comparison: Payment Orchestration vs Payment Gateway

| Feature | Payment Gateway | Payment Orchestration |

| Purpose | Processes individual transactions. | Manages multiple payment systems. |

| Scalability | Limited, ideal for small businesses. | Highly scalable, great for global growth. |

| Cost Savings | More expensive for high volumes. | Routes payments to save costs. |

| Flexibility | Fixed payment options. | Dynamically adapts to payment needs. |

| Analytics | Basic transaction data. | Detailed real-time insights. |

| Security | Standard fraud tools. | Advanced multi-layer protection. |

Both options serve unique purposes. If you’re running a small online store, a payment gateway might meet your needs. But if you’re expanding globally or managing high transaction volumes, payment orchestration offers significant advantages.

Latest Trends in Payment Processing

Here are some stats and trends to consider:

- Ecommerce Growth: Ecommerce sales are projected to grow to over $8 trillion globally, creating a huge demand for modern payment solutions.

- Rise of Multi-Gateway Integrations: Over 50% of businesses now manage five or more payment integrations to serve different customer needs.

- Global Payment Preferences: Offering local payment methods (like Pix in Brazil or iDEAL in the Netherlands) can improve conversion rates.

- AI and Fraud Prevention: Payment orchestrators are increasingly using AI to detect fraud and route payments efficiently. These trends emphasize the growing need for flexible, scalable solutions like payment orchestration.

Which One Should You Choose?

Choose a Payment Gateway If:

- You are a small business with simple needs.

- You want to get started quickly and process online payments securely.

- You don’t need to manage multiple gateways or currencies.

Choose Payment Orchestration If:

- You’re a growing business looking to expand globally.

- You manage high volumes of ecommerce payments or cross-border transactions.

- You want to reduce costs by dynamically routing payments to the cheapest provider.

- You need advanced tools for fraud protection, analytics, and integration. For example, if you’re an ecommerce store with customers from different countries who use various payment methods, a payment orchestration platform is ideal. It ensures smoother transactions and fewer interruptions.

Conclusion

The decision between Payment Orchestration vs Payment Gateway depends on your business size, goals, and payment complexity. Investing in the right payment solution now can save you headaches later—and help your business thrive in a fast-changing digital economy!

We at Loyal Web Solutions offering ecommerce solutions for WooCommerce, Shopify, Bigcommerce, Magento, Laravel, etc. with a proven track record of integrating both discussed payment systems.

Get in touch with us for professional help now!

Author Bio

By Vishal Patel

Vishal Patel is the Chief Technology Officer at Loyal Web Solutions, where he has been a key leader since 2011. With a deep understanding of web technologies and a passion for innovation, Vishal has guided the company to consistently deliver top-tier digital solutions. His expertise in the industry ensures that every project is executed with precision and excellence.